by Rod Williams, May 3, 2024- Anytime a property tax increase is proposed, those supporting an increase will argue that Nashville has a low tax rate. Nashville's rate for the urban district, which is most of us living in Davidson County is $3.254. That is lower than the combined city-county rate in Knoxville which is 3.7096. It is considerably lower than Memphis at $6.09164, and also lower than many other places in Tennessee. I have not been convinced by this argument, however. I have argued that a comparable house in Nashville cost more than a comparable house in many other places and argued that the tax bill was what mattered, not the tax rate.

Well, I have discovered data that takes that into consideration. Compared to most urban areas in America, our property taxes are modest.

First of all, one needs to understand what goes into determining the property tax bill. First, is the value of the property which is the appraisal. Many years ago, local appraisers had a lot of say into determining the appraised value and some kept them artificially low. Now, not so much. Local elected Property Assessors are supervised by the state and properties are appraised at or near market value and kept current with periotic reappraisals. The other factor is the assessment which is a percentage of the appraisal. Commercial, industrial and residential have different assessment rates. In Tennessee the assessment is 25% of the appraisal for residential property. The tax rate is rate adopted by the council and is applied to each $100 of assessment. Here is an example of how to calculate one's taxes:

To calculate the tax on your property, assume you have a house with an APPRAISED VALUE of $100,000. The ASSESSED VALUE is $25,000 (25% of $100,000), and the TAX RATE has been set by the Metro Council at $3.254 (Urban Services District) per hundred of assessed value. To figure the tax simply multiply the assessed value ($25,000) by the tax rate of $3.254.

Urban Services District Tax Rate $3.254

$25,000 / 100 = 250 x $3.254 = $813.50

or $25,000 x .03254 = $813.50) for a tax bill of $813.50

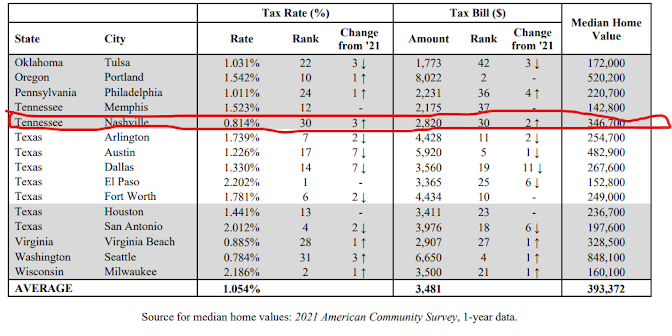

The Lincoln Institute of Land Policy examines 74 large U.S. cities and a rural municipality in each state and arrives at an effective tax rate, that is, the tax bill as a percent of a property’s market, for each municipality. Of all of the municipalities included in the study, Nashville ranks as the 30th highest tax rate. By comparison Memphis has the twelfth highest tax bill of the 74 municipalities.

Nashville's effective property taxes are among neither the highest nor the lowest in the nation.

Sometimes a low tax rate may nevertheless result in a high tax bill and vice versa.

There is still an issue of how much of our county is in the urban services district and how that figures into our property tax burden compared to other counties. Our General Services District is the equivalent to what in other counties would be "county," not within an incorporated area. Even that comparison would skews toward lower a lower tax bill for Davidson County. Davidson County's General Services District tax rate is $2.922; Shelby County's tax rate is 3.39000.

None of this is to say that we are under taxed. However, compared to most other urban areas of the nation we pay lower property taxes.

Top Stories

Top Stories

No comments:

Post a Comment