Committee for a Responsible Federal Budget, published July 31, 2024 -Earlier today, former President Donald Trump suggested eliminating the partial income taxation of Social Security benefits, which currently helps fund the Social Security and Medicare Hospital Insurance (HI) trust funds. Without a replacement source of revenue, we estimate repealing taxation of benefits for seniors would:

- Increase deficits by $1.6 trillion to $1.8 trillion through 2035

- Increase Social Security’s 75-year shortfall by 25 percent – or 0.9 percent of payroll

- Nearly triple the Medicare HI 75-year shortfall, increasing it by 0.6 percent of payroll

- Advance the insolvency date of Social Security’s retirement trust fund by over one year

- Advance the insolvency date of the Medicare HI trust fund by six years

| US Budget Watch 2024 is a project of the nonpartisan Committee for a Responsible Federal Budget designed to educate the public on the fiscal impact of presidential candidates’ proposals and platforms. Throughout the election, we will issue policy explainers, fact checks, budget scores, and other analyses. We do not support or oppose any candidate for public office. |

In a post on Truth Social today, President Trump declared that “SENIORS SHOULD NOT PAY TAX ON SOCIAL SECURITY!”

President Trump is likely referring to the fact that some Social Security benefits are currently taxed as ordinary income and have been since 1984.

Under current law, seniors that earn less than $25,000 per year ($32,000 for married couples) of “combined income” – that is adjusted gross income plus certain adjustments and half of their Social Security benefits – pay no taxes on Social Security retirement benefits. Above that amount, 50 percent of Social Security benefits are subject to income tax, with the revenue going toward the Social Security retirement trust fund. For seniors earning combined income above $34,000 per year ($44,000 for married couples), an additional 35 percent of benefits are taxable, with this revenue going toward the Medicare HI trust fund.

Although taxation of benefits has been a relatively modest source of revenue over the past 40 years, revenue collection is growing over time because Social Security benefits are getting larger and the thresholds for exempting benefits from taxation are not indexed to inflation. This year, for example, taxation of benefits is projected to raise about $94 billion.

Based on data from the Social Security and Medicare Trustees, we estimate that eliminating taxation of Social Security benefits for seniors would cut taxes and thus reduce revenues by about $1.8 trillion between Fiscal Year (FY) 2026 and 2035. This includes $1.05 trillion less in revenue collection for Social Security and $750 billion less revenue for Medicare. Based on data from the Congressional Budget Office (CBO), the total reduction in revenue would be $1.6 trillion, with $950 billion less revenue for Social Security and $650 billion less for Medicare. In these estimates, we assume benefits for non-seniors – including those benefiting from the Social Security Disability Insurance (SSDI) program – continue to be taxed.

Effects of Ending Taxation of Social Security Benefits

| Ten-Year Revenue Impact (CBO) | Ten-Year Revenue Impact (Trustees) | Effect on 75-Year Actuarial Balance | New Insolvency Date | |

|---|---|---|---|---|

| Social Security Revenue | -$950 billion | -$1.05 trillion | -0.9% of payroll | 2032 (-1 year) |

| Medicare HI Revenue | -$650 billion | -$750 billion | -0.6% of payroll | 2030 (-6 years) |

| Total | -$1.6 trillion | -$1.8 trillion | N/A* | N/A |

Note: Ten-year budget window is from FY 2026 through FY 2035.

*Percentages of payroll are relative to the Social Security and Medicare tax bases, and thus are not additive.

Sources: CRFB estimates based on Congressional Budget Office, Social Security Trustees, and Medicare Trustees data.

This revenue reduction would grow over the long run, significantly widening Social Security’s and Medicare’s 75-year actuarial imbalances. Based on Trustees’ data, we estimate the Social Security Old-Age and Survivors’ Insurance (OASI) trust fund imbalance would grow by roughly 25 percent – or about 0.9 percent of payroll – from 3.6 percent of taxable payroll to 4.5 percent. Meanwhile, the Medicare HI trust fund imbalance would nearly triple – increasing by 0.6 percent of payroll – from 0.35 percent of payroll to nearly 1.0 percent. This assumes the lost revenue isn’t replaced with revenue from other sources.

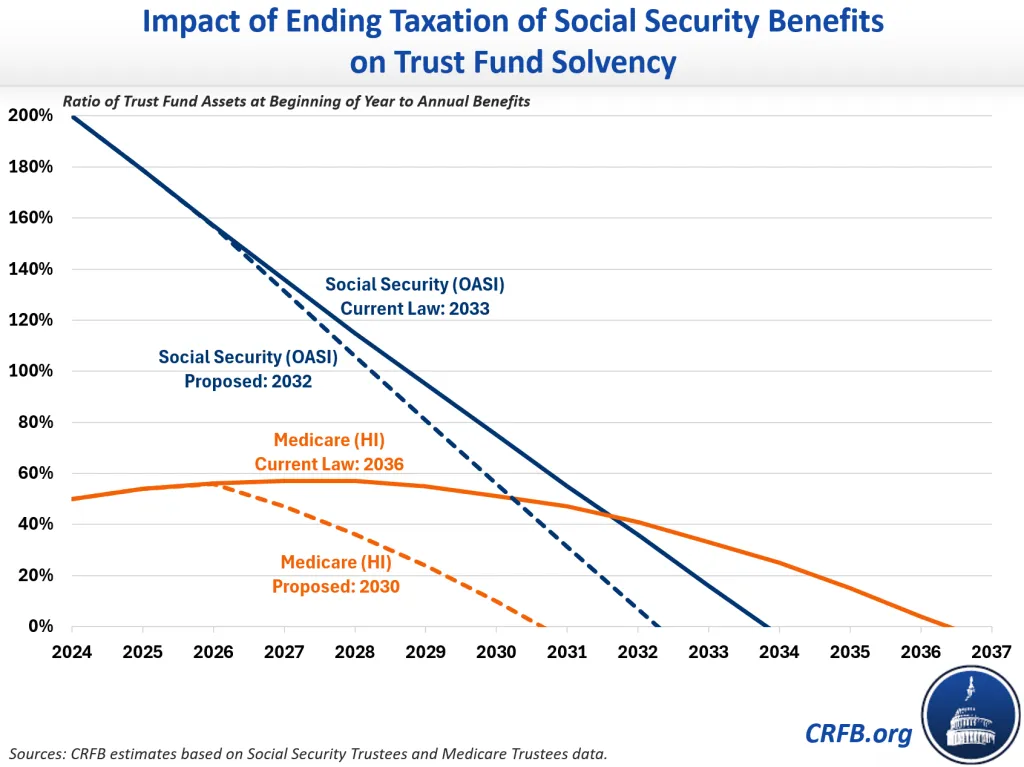

As a result of these changes, Social Security’s retirement trust fund would become insolvent more than one year earlier – in early 2032 instead of late 2033. Medicare’s insolvency date would advance by six years – from 2036 to 2030.

Upon insolvency, the law requires spending to be cut to match revenue. The 21 percent cut to Social Security benefits projected under current law would expand to 25 percent under this proposal. After-tax benefits would not meaningfully change – though reductions would be larger for lower income seniors and smaller for higher income seniors.

Importantly, consequences would differ if taxation of benefits were replaced with another source of revenue or offset with changes to benefits.

Top Stories

No comments:

Post a Comment